The Hoonigan Bankruptcy is Bullshit

Change your name and lead 27 brands into bankruptcy — the Wheel Pros story

HAPPY RACE DAY! especially to Travis Pastrana who taught his daughters to do stick-shift donut drifts in the rain. This parenting technique is Race Day approved.

Here’s this week’s top story.

Stop Calling it Hoonigan. This is a Wheel Pros Bankruptcy.

The latest bombshell in automotive media dropped on Monday when the company known as Hoonigan filed for Chapter 11 bankruptcy in a Delaware court.

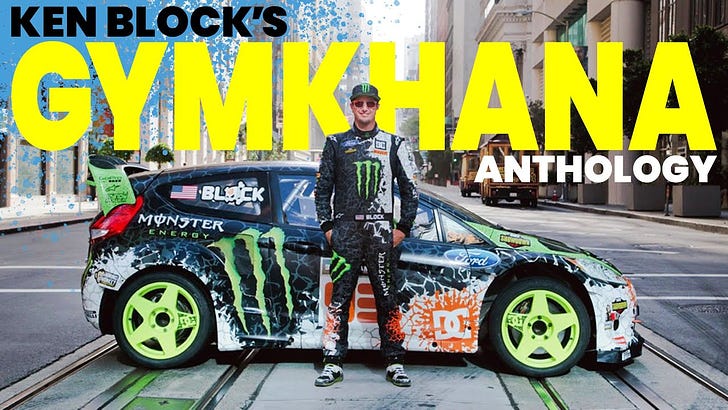

Hoonigan was an innovative, trend-setting media brand for more than a decade. But after the untimely passing of co-founder Ken Block (pictured above), a corporate acquisition and mass exodus of talent — including the departure of the other co-founder Brian Scotto — the company is in a very different place. We explained back in February why its experience with private equity should be a warning to media companies everywhere.

And now it’s bankrupt. After poring over the court documents filed by the company on Monday, here are my five takeaways that tell a clearer picture.

The DBA Means Everything

Let’s start with the name. The company itself declared that Hoonigan took Monday’s action, and news outlets followed suit by reporting that Hoonigan filed for bankruptcy. But the company’s name is not Hoonigan. It’s Wheel Pros, LLC. After purchasing Hoonigan in 2021 for an undisclosed sum, and without either original co-founder still on board, Wheel Pros announced in 2023 that it rebranded as Hoonigan. But that’s not the same as a name change. Wheel Pros filed a DBA, or “Doing Business As” name, which is essentially going by a nickname. This is the automotive equivalent of Kobe Bryant suddenly coining himself “Black Mamba.” You can adopt a new persona all you want, but deep down you’re still Kobe. Wheel Pros is still Wheel Pros: In the company’s 63-page reorganization plan the word “Wheel Pros” appears 25 times. The word “Hoonigan” appears once, in the CEO’s email address.

Twenty-Seven Affiliates

After the “Hoonigan” bankruptcy was announced, everyone wondered how a popular media company amounted $1.2 billion in debt. The answer? It didn’t. Court files show that it wasn't just Wheel Pros that filed for bankruptcy, but a total of 27 affiliate companies under its corporate umbrella that each filed petitions for Chapter 11. Only three of those companies are original Hoonigan brands. The other 24 are various automotive brands, nine of which are named “Wheel Pros” or “WP.” (For instance, there’s a “Wheel Pros Parent, LLC” and a “Wheel Pros Parent II, LLC.”) Long story short, Wheel Pros amassed a collection of 27 companies, pooled their debts and made them all file bankruptcy. This is textbook private equity, similar to when Toys “R” Us crumbled under sudden immense debt or when Red Lobster literally had its land sold out from under it.

Where’d the Debt Come From?

In its filings, the court required Wheel Pros, LLC to list its 30 largest unsecured creditors that are owed money. The top three are:

the Wilmington Trust investment firm at $92.7 million;

Nitto Tire company at $18 million;

and Hong Kong firm Sinolion International Trading at $10.7 million.

But the vast, vast majority of money owed comes from massive loans. Wheel Pros amassed a total of $1.75 billion in funded debt obligations, including more than $1 billion in first lien loans that allow creditors to seize the company's collateral until their losses are repaid. Wheel Pros plans to eliminate approximately $1.2 billion of that total through a restructuring plan, and can access up to $285 million in “debtor-in-possession” loans designed to help corporations navigate Chapter 11 expenses. So, don’t cry for Wheel Pros.

They can call it Hoonigan all they want. This is a Wheel Pros bankruptcy.

Sales Were Down… Way Down

Recently we reported business has been slow across several segments of the automotive aftermarket. Custom wheels, the bulk of Wheel Pros’ business, in particular took a hit. Soon after acquiring Hoonigan, net sales dropped 24.4 percent in late 2022. That caused the company’s EBITDA, an indication of its overall earning potential, to plummet by 77% from the year prior. Nine months later Wheel Pros filed the DBA to become Hoonigan. This wasn’t about Hoonigan failing to sell enough stickers and t-shirts; it’s more likely that Wheel Pros failed to adapt to a suddenly stagnant market. Did execs see the writing on the wall and adopt a popular name to soften the blow of looming bankruptcy? Or was the name change an effort to breathe life into its sales? Either way, a challenging business environment likely accelerated Wheel Pros’ troubles.

Hoonigan Isn’t Going Anywhere

It’s unlikely that Wheel Pros or Clearlake Capital, the private equity firm that owns it, is in the business of squandering Hoonigan’s 5M Instagram followers and 5.73M YouTube subscribers. Bankruptcy does not mean Hoonigan is shutting down. If anything, the purpose of filing Chapter 11 is to reemerge in a healthier state afterward so you can continue operations. Court filings indicate Wheel Pros still has a long-term vision that no doubt includes Hoonigan. We’ll see where things go from here, but I wouldn’t bet on Hoonigan videos come to a halt anytime soon.

And Finally…

Believe it or not, SEMA is right around the corner. The countdown for builders to finish their stunning projects is well underway, and I’ll be speaking with several over the next few weeks.

The post-show SEMA Fest is also returning after its debut last year, and you can find a Forbes article on their plans to grow the event here. Sure, they’re cutting it from two days to one. But I’m still optimistic it can find success. Maybe I’ll see you there.

Thanks for reading. Please consider sharing our newsletter with your friends.

Check out Carrara Media on Instagram, Twitter and Facebook and visit our store to order one of our many fine books and eBooks.

There’s so much cliche response to this filing as “typical PE playbook” as if PE intended to go bankrupt the whole time. As if the PE firm principals somehow get rich by bankrupting companies. So much misunderstanding and ignorant echo chamber repeating of this “well known fact.”

If the intention was to simply pocket management fees from investors, and then avoid the debt obligation that funded the whole enterprise, this was a tedious and expensive way to do that, and they didn’t have a lot of time, given the quick collapse, to pocket a lot of fees.

Unless your thesis is to buy distressed companies and sell them for parts, a PE fund gets rich by buying low and selling high. To another investor. The fees made along the way is just gravy, it’s not the meat of the potential payoff. So people need to stop buying into the dumb trope that “this is what PE does.”

A lot of bank debt was taken by Wheel Pros to fund the purchase of lots of brands, when bank loans were cheap. When interest rates started climbing, the Fed’s attempt to quell pandemic-caused inflation, their debt service suddenly started to get very expensive. Business bank lending is variable rate (except for mortgages). No one saw the pandemic coming. And no one saw the massively compromised supply chain issues during the pandemic, which hurt companies’ abilities to service demand (and get paid and service their debt) or the sudden drop in demand as the pandemic subsided (and interest rates did not).

This was the perfect storm.

And they’re not the only high profile bankruptcy caused by this sequence of events.

I think the issue PE firms run into is that the leverage they put on companies requires high cash generation to repay debt. This works well with stable non-cyclical companies but gets tough when the business requires a lot of cash, for example to turn around the company. The high debt constrains what the company can invest in.